MidweekPay.com Review: Is Midweekpay Legit Or Scam?

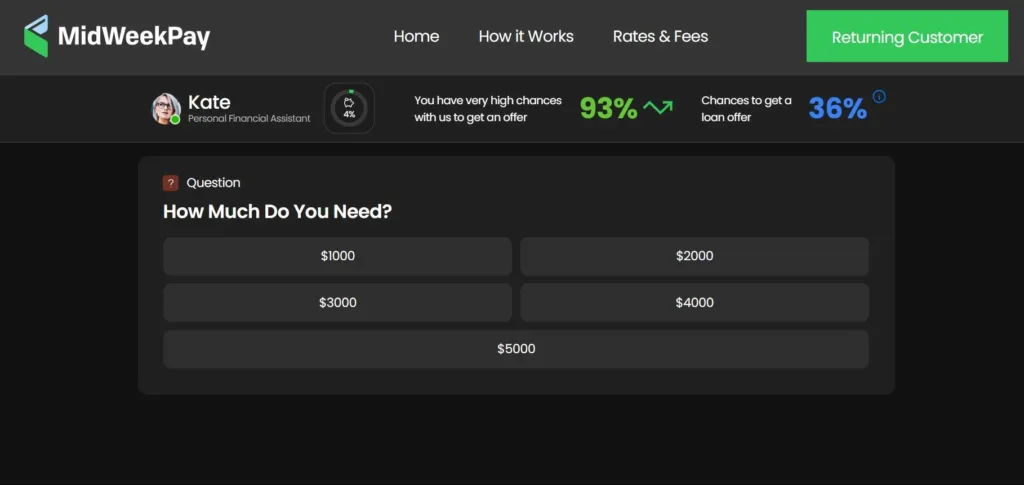

In our busy world, sometimes we need money unexpectedly. When that happens, some folks use online loans to get cash fast. MidweekPay.com positions itself as a solution, connecting borrowers with a network of lenders for personal loans ranging from $100 to $5,000.

But before you share your money info, it’s important to know if MidweekPay.com is safe and if there are any downsides to using it.

The Convenience Factor

MidweekPay.com highlights its user-friendly approach. Borrowers can apply for loans from the comfort of their homes or while on the go using their mobile devices. This eliminates the need to visit physical banks or lenders and potentially wait in lines.

The application process is streamlined – you simply fill out an online form and your request is forwarded to MidweekPay.com’s network of lenders. Ideally, you could receive a response within minutes. Once approved, the lender deposits the funds directly into your bank account, sometimes even the next day.

Is Midweekpay.com Legit?

However, there are several red flags associated with MidweekPay.com that warrant caution:

1. Missing Contact Information

Midweekpay.com does not have “Contact Us” page on their website. There’s no phone number, email address, or physical address provided. This makes it difficult, if not impossible, to reach customer support directly if you encounter issues or have questions.

2. Limited Transparency

The absence of an “About Us” page raises concerns about the ownership and team behind MidweekPay.com. A legitimate company would typically provide information about its founders, management, and core values.

3. Spam Text Messages

Numerous user reviews on platforms like Trustpilot and Reddit report receiving persistent spam text messages from MidweekPay.com even after opting out. This aggressive marketing tactic reflects poorly on their business practices and raises privacy concerns.

4. Unnecessary Middleman

It’s worth questioning the need for a middleman like MidweekPay.com when you could potentially get a better deal directly from a bank or reputable online lender. Banks often offer personal loans with competitive interest rates and established customer support structures.

5. Data Security Risks

Sharing personal information like driver’s license details, phone number, email address, and bank account information with a platform lacking transparency raises security concerns. Without knowing who operates MidweekPay.com and their data security measures, there’s a risk of your information being compromised.

6. Negative User Reviews

Several negative reviews on Trustpilot highlight user dissatisfaction with high-interest rates, hidden fees, and aggressive debt collection practices from lenders connected through MidweekPay.com.

While MidweekPay.com offers a seemingly convenient way to access quick cash, the red flags associated with the platform – lack of transparency, aggressive marketing tactics, and potential security risks – outweigh the supposed convenience.

There are safer and potentially more affordable alternatives available. If you’re considering a personal loan, exhaust all your options and prioritize reputable lenders with clear communication and established customer support structures.

Remember, a responsible approach to borrowing involves understanding all the terms and conditions before committing to any loan.

Read: Xfinityrefunds.com Review: Is Xfinityrefunds Legit OR Scam?